If you will be operating a physical store or. Tax rate collected is based upon established county rate You can do this in a couple of different ways, and there are several types of licenses to choose from as well.

Vendors must have a separate license for each business location for which they are operating Contract and Payment Bedding Permit Application Columbus Public Health City of Columbus Storm Water Credit Card Authorization Form Fire Marshal Guidelines.For vendors with a fixed place of business (i.e., store, restaurant) or have a location from which the business is dispatched (i.e., landscapers, janitorial and maintenance service providers).Retailers with a fixed place of business may also apply for a vendor’s license with their County Auditor. A Retail (County) Vendors License is required for selling taxable goods at a. Ohio law requires any person or business making taxable retail sales or services to register for an Ohio Vendor’s License with the Ohio Department of Taxation. All requests should be faxed to the Compliance Division at (614) 387-1847. There are two different types of vendors licenses: Retail Vendor and Transient. A partial list of codes can be viewed from the Ohio Department of Taxation.Ī list of county vendor licenses that have been issued may be obtained from the Ohio Department of Taxation.

#APPLY FOR VENDORS LICENSE OHIO REGISTRATION#

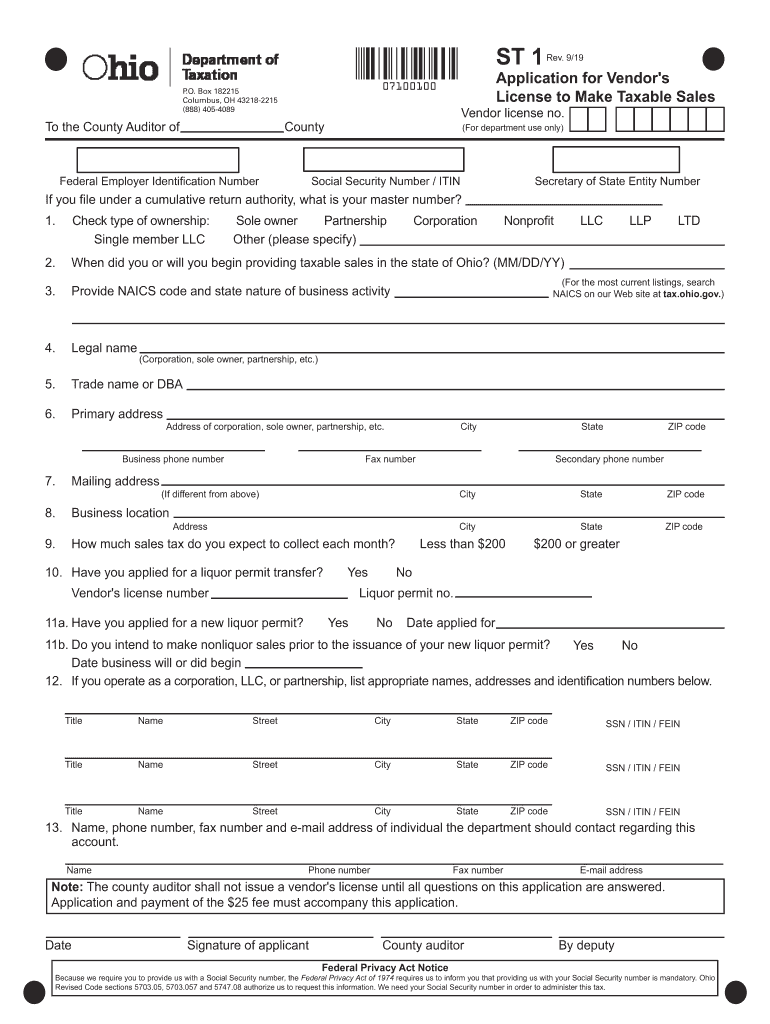

When completing a vendor's license registration form, business owners will need to know the North American Industry Classification System (NAICS) code.

A vendor’s license is available through the Auditor’s office, the Ohio Department of Taxation or the Ohio Business Gateway. Ohio law requires a vendor’s license for any business making retail sales of tangible personal property or taxable services from a fixed or transient location, including internet sales.

0 kommentar(er)

0 kommentar(er)